Key words: Graphite Electrodes, Refractory Material(brick, Mix), Copper Mould Tube, Mill Roll

+86 186 4091 3888

Key words: Graphite Electrodes, Refractory Material(brick, Mix), Copper Mould Tube, Mill Roll

+86 186 4091 3888

Dec. 27, 2021

While the eye-catching ultra-high power (UHP) electrodes that shine in electric arc furnaces (EAFs) have always been a central component of melt shop operations. They have rarely been the focus of attention in the steel products market, where they play a critical role in the upstream part of the process.

That changed when the steel industry realized there was a shortage of UHP graphite electrodes, and their prices soared as steelmakers scrambled to secure supplies. Some steel production was cut as steel producers tried to protect dwindling electrode inventories.

While UHP electrode prices have fallen from last year's panic-driven peak (reported at $20,000-30,000 per ton), they remain high by historical standards. So, what factors led the spotlight to fall on UHP electrodes? What is the outlook for them now?

As a Japanese company with international operations, Showa Denko, a wide-ranging chemicals business, claims to be the world's largest supplier of ultra-high voltage graphite electrodes. Takahashi, managing director and general manager of the carbon division of Showa Denko Co., Ltd (SDK), headquartered in Showa Denko's Tokyo headquarters, said the total global production capacity for UHV graphite electrode production outside of China is currently about 800,000 tons per year. The company estimates that current UHP quality graphite electrode production capacity in China is approximately 50,000 tons per year.

Takahashi said the Showa Denko Group's UHV electrode production capacity will soon reach about 250,000 tons per year, supplying about 30 percent of the global market. How does he explain the shortage that many electric arc furnace steelmakers seemed unaware of last year? The answer goes back to that period a few years ago, when the world steel market was generally weak and demand for UHV graphite electrodes was correspondingly low. As a result, about 25 percent of the market was taken, which refers to the decline in global electrode capacity.

When the steel market started to recover, demand for electrodes picked up in response to the improved global economic conditions. There is a huge imbalance between steelmaking based on electric arc furnace steelmaking outside of China.

Since the steel market was so bad for several years, steelmakers reduced their stocks of graphite electrodes and the supply chain was empty. As a result, steelmakers realized there was a shortage of supply and pushed the panic button.

Takahashi added that the electrode shortage was exacerbated by the "very limited" supply of needle coke. "We need good quality needle coke to produce ultra-high voltage electrodes," he explains, but stresses that not many companies can produce it, and there are few new suppliers. The increased demand for needle coke for battery production is also not helping to balance supply and demand. And, according to some reports, some needle coke production in China has been reduced as part of a national policy to reduce air pollution.

All in all, this is a challenging time for graphite electrode producers.

Is China's electrode production capacity not growing despite the UHP electrode shortage?

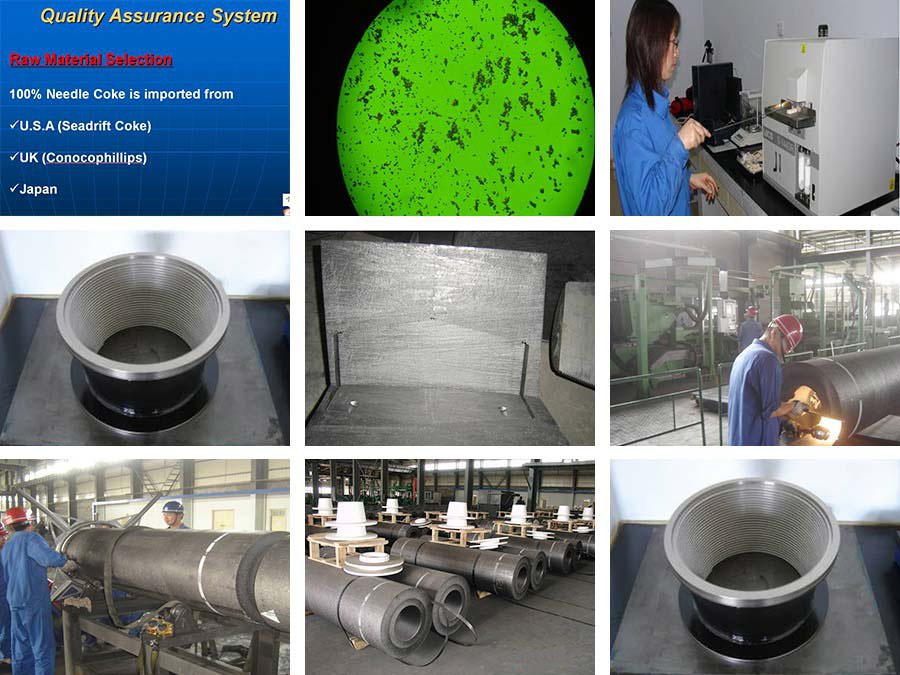

The quality of UHP electrodes depends not only on the availability of high-specification needle coke, but also on the technical expertise in each of the major process steps to manufacture them, especially baking, extrusion and graphitization.

With the increase in Chinese steel scrap production and the growing share of electric furnace steelmaking as the country increases recycling efforts, the demand for UHP graphite electrodes in China does have tremendous long-term growth potential.

International UHP graphite electrode producers negotiate prices for their products directly with their diverse customer base. These products are available in a variety of standard and special sizes, so their manufacturers are reluctant to discuss specific prices publicly. Recently, prices have converged in China, other parts of Asia, Europe and the United States.

Monitoring each plant's key performance indicators and comparing them to those of sister plants in the group helps determine their relative position. For example, the number of people required to produce one ton of UHP graphite electrodes varies from 2 to 20 people. Energy and labor costs are also being monitored and compared.

The basic quality parameters of the electrodes produced are low coefficient of thermal expansion, high bending strength and low resistance. sinometal provides technical services and advice to steel producers.

SINOMETAL plans to increase productivity and reduce operating costs; improve power and process profiles; reduce energy consumption; and optimize carbon/oxygen injection and chemical energy consumption.

Most electrode producers follow a similar six-stage production process, but their capabilities and equipment efficiency vary.

For most large international technology and equipment suppliers, in addition to striving to take advantage of SGL Carbon's integration, SINOMETAL's focus is to be a good partner to the steel industry and to build long-term relationships with our customers. We want to provide our customers with products when and where they need them, and at a reasonable price.

Navigation

Tel:: +86 186 4091 3888

Fax: +86 411 3962 5877

Mobile: +86 186 4091 3888

E-mail: jack@sncarbon.cn

QQ: 695993847

Address: Zhongshan District, Dalian City,116001. China.